After weeks of aggressive lobbying at both the state and federal levels, IATSE has successfully petitioned Congress to pass the “CARES” act for entertainment industry workers as part of the new “Families First” economic stimulus package, which has officially been signed into law as of today, March 27.

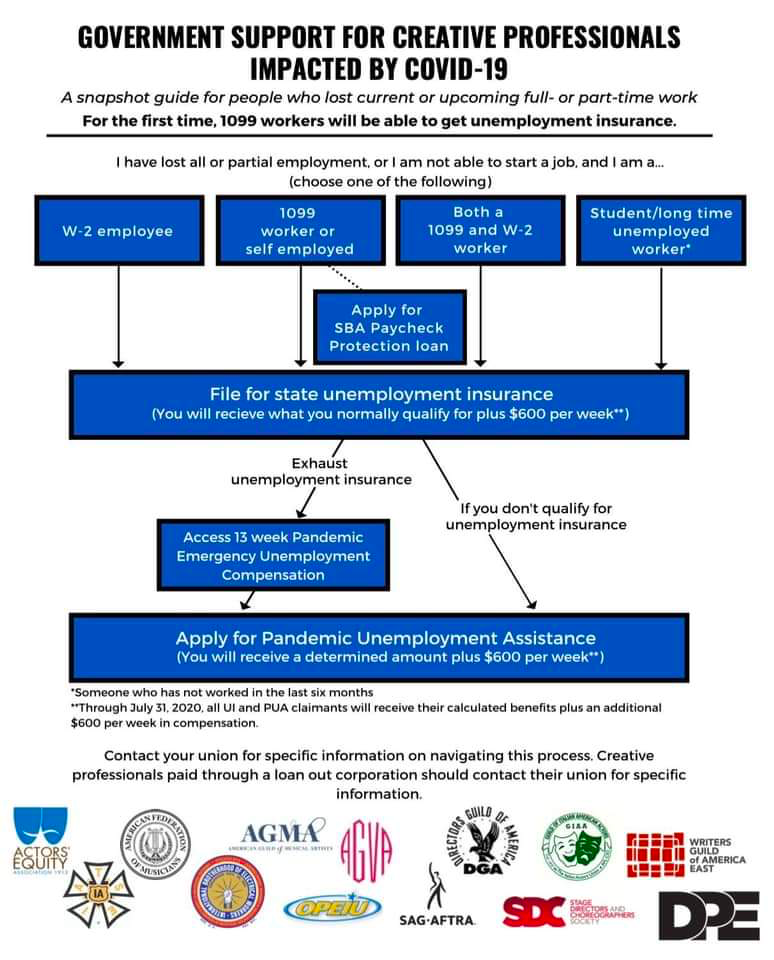

The CARES act will provide direct relief to entertainment industry workers, in addition to the funding they are eligible to receive through the Families First bill. Please reference the graphic below for best practices on navigating the options available to you.

Both bills provide our members, including freelancers and gig workers, with an additional path to maintaining a steady income while our industry remains at pause.

IATSE is proud to fight and win for our members, and we hope you rest assured knowing that we are doing everything in our power to support you through this challenging time.

Please review this comprehensive breakdown of the benefits available to you through the Families First and CARES provisions, and feel free to contact the union hall with any questions.

Families First:

- Direct, one-time payments to individuals and families

- Expanded unemployment insurance

- Loans and potential loan forgiveness for small and medium sized companies, like our contractors

Most IATSE Local 11 members, as well as freelancers and gig workers, who have lost work due to the virus will be eligible to collect one-time, direct payment checks.

Individuals earning up to $75,000 annually will receive a check for $1,200. The check value will decrease respectively as an individual’s income exceeds $75,000, up to the limit of $99,000. Folks who earn more than $99,000 are ineligible for a check.

Similarly, married couples who earn up to $150,000 will receive $2,400, plus $500 per each dependent 16 years of age or younger.

If you haven’t filed your taxes in recent years, it could affect your ability to receive this payment.

Members who have lost work due to the virus are also eligible to collect expanded Unemployment Insurance (UI) through the State of Massachusetts. UI is now expanded to provide participants with an extra $600 per week for four months, and also allow them to remain on unemployment for 13-weeks longer.

In Massachusetts that will likely mean participants can collect UI for 39 weeks total. This is a critical first step toward maintaining a steady income. Please click here to apply.

It is important to note that even if you were not fully laid off, if your hours/pay were CUT, or you were forced to QUARANTINE due to the virus, you are STILL ELIGIBLE to collect unemployment.

——————————

Coronavirus Aid, Relief, and Economic Security (CARES) Act:

- Creates a Pandemic Unemployment Assistance program to provide payment to those not traditionally eligible for unemployment benefits, who are unable to work as a direct result of the coronavirus public health emergency. This includes entertainment workers with limited work history, and/or scheduled, or offered, work that did not commence.

- Provides an additional $600 per week payment to each recipient of unemployment insurance or Pandemic Unemployment Assistance for up to four (4) months.

- Provides an additional thirteen (13) weeks of unemployment benefits to help those who remain unemployed after weeks of state unemployment are no longer available.

- Provides one-time direct payments of $1,200 for all individuals making up to $75,000; $112,500 for head of household. Married couples making up to $150,000 who file a joint return are eligible for $2,400. Those amounts increase by $500 for every child. The check amount is reduced by $5 for each $100 a taxpayer’s income exceeds the phase-out threshold. The amount is completely phased-out for single filers with incomes exceeding $99,000, $136,500 for head of household filers, and $198,000 for joint filers.

- Waives the 10-percent early withdrawal penalty for distributions up to $100,000 from qualified retirement accounts for coronavirus-related purposes.

IATSE Local 11 is thrilled to have fought and won for our members during this time of great stress, and uncertainty for all.

We will continue to fight, alongside our International Alliance and other allies, to win you even more relief, including pension relief, access to affordable healthcare, and economic support for the entertainment industry to put people back to work.

I hope this brings you some peace of mind as even now, the situation continues to transform each day. Please contact the union hall at 617-5999 with any questions.

In solidarity,

Colleen Glynn

Business Manager

IATSE Local 11